Elliott Wave Theory : Basic Patterns, Rules and Guidelines

What is the Elliott Wave Theory ?

The Elliott Wave Theory, is a form of technical analysis to predict future market movements.

It was founded by Ralph Nelson Elliott (1871-1948) who was an American accountant. He developed a model for the underlying social principles of financial markets by studying their price movements.

In the 1930s he proposed that market prices develop in specific patterns, which today is called Elliott Waves.

It's Important to understand that markets are driven by the mass of investors by their emotions and psychology and this is what the Elliott Wave is about.

I always say, the book is already written and the Elliott Waves lead you to the next page.

1. Motive Wave (IMPULSE)

Guideline: Motive Wave

The impulsive structure of wave 1 tells us that the move in the next major degree of the trend is also up.

We are also warned that there will be a three-wave correction against the trend.

This correction in wave 2 is followed by wave 3, 4 and 5, completing this impulsive sequence.

Impulse patterns occur in wave 1, 3 and 5.

In a correction also in wave C, wave A can be an impulse, but it doesn't has to be!

Impulse waves always consist of five waves, designated 1,2,3,4,5.

Wave 1, 3 and 5 are themselves impulse waves. Wave 2 and 4 are always corrective waves.

Rules

– Wave 1 must be an impulse or a leading diagonal.

– Wave 2 can be any correction pattern except a triangle.

– Wave 2 may not correct more than 100% of wave 1 (start of wave 1).

– Wave 3 must be an impulse.

– Wave 3 can not be the shortest wave of the three impulse waves, namely wave 1, 3, and 5.

– Wave 4 can be any correction pattern (ZigZag, Double or Triple ZigZag, Triangle, Flat, Double or Triple three).

– Wave 4 is not allowed to cross wave 1 territory (wave cut).

– Wave 5 must be an impulse or an ending diagonal.

2. Leading Diagonal (LDT)

Rules: Leading Diagonal (LDT)

– Structure 5-3-5-3-5.

– Occurs in wave 1 or wave A.

– Wave 4 crosses wave 1 territory (wave cut).

– A wedge shape or channel within two converging or parallel lines.

– The leading diagonal is the beginning either of a new impulse (wave 1) in the higher sequence or the start of a correction (wave A).

3. Ending Diagonal (EDT)

Rules: Ending Diagonal (EDT)

– Structure 3-3-3-3-3.

– Occurs in wave 5 or wave C.

– Wave 4 crosses wave 1 territory (wave cut).

– A wedge shape or channel within two converging or parallel lines.

– Even tough all internal waves are corrective (ABC ) the ending diagonal still belongs to the impulsive pattern.

– The ending diagonal (wave 5,C) is the final wave before a correction starts.

4. Zig Zag Correction

Rules: Zig Zag Correction

– Structure 5-3-5.

– Wave A must be an impulse.

– Wave B must be a corrective pattern

– Wave B must be shorter than wave A.

– Wave C must be an impulse.

– A Zig Zig is the most common corrective pattern.

– A Zig Zag is a strong correction against the trend as ABC.

5. Flat Correction

Rules: Flat Correction

– Structure 3-3-5.

– Wave A must be a corrective pattern.

– Wave B must be a corrective pattern.

– Wave B ends of the start of wave A (flat).

– Wave C is an impulse.

– Wave C ends at the same level at the end of wave A.

– Flat corrections are very common patterns and signal a sideways correction.

6. Expanded Flat Correction

Rules: Expanded Flat Correction

– Structure 3-3-5.

– Wave A must be a corrective pattern.

– Wave B must be a corrective pattern.

– Wave B extend above the beginning of wave A.

– Wave C is an impulse.

– Wave C ends clearly below at the end of wave A.

– Expanded flat corrections are special types of flat corrections.

7. Running Flat Correction

Rules: Running Flat Correction

– Structure 3-3-5.

– Wave A must be a corrective pattern.

– Wave B must be a corrective pattern.

– Wave B extend above the beginning of wave A.

– Wave C is an impulse.

– Wave C ends above the end of wave A.

– Typical in wave 2 or B

– Running flat corrections are special types of flat corrections.

8. Contracting Triangle

Rules: Contracting Triangle

– Structure 3-3-3-3-3.

– A contracting triangle has 5 waves (A,B,C,D,E)

– All 5 Waves are corrective waves.

– Triangles occur only in wave B,X,Y,4.

– Never in a wave 2 or A.

– Triangles have a chance of 50/50. It can dissolve either up or down.

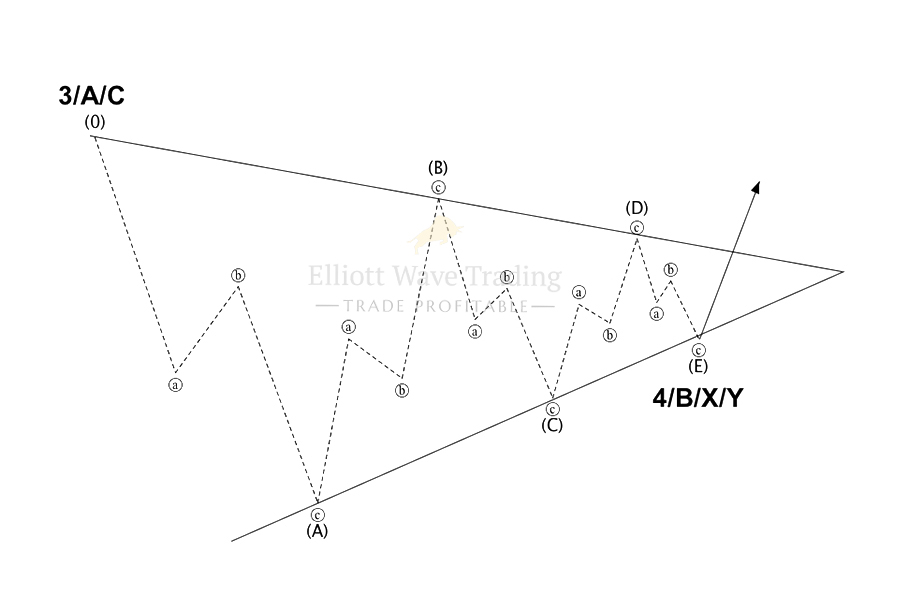

9. Expanding Triangle

Rules: Expanding Triangle

– Structure 3-3-3-3-3.

– A contracting triangle has 5 waves (A,B,C,D,E)

– All 5 Waves are corrective waves.

– Triangles occur only in wave B,X,Y,4.

– Never in a wave 2 or A.

– Triangles have a chance of 50/50. It can dissolve either up or down.

10. X Waves Correction

Guideline: X Waves Correction

Many types of combinations are possible.

Here's an example:

Counting Double A–B–C-(W)–A–B–C–(X)–A–B–C–(Y).

Count triple A–B–C–(W)–A–B–C–(X)–A–B–C–(Y)–A–B–C–(X2)–A–B–C–(Z).

Elliott calls sideways combinations of corrective patterns “double threes and triple threes.”

The first pattern is usually a ZigZag or a Flat. Double threes and triple threes, can also represent a simpler corrective pattern, including the various types of zigzags, flats and triangles. For double and triple ZigZags, any extended corrective action is designated W, Y and Z. The reactionary X-wave can take the form of any corrective pattern, but most commonly are ZigZags.